》View SMM Copper Quotes, Data, and Market Analysis

》Click to View Historical Price Trends of SMM Spot Copper

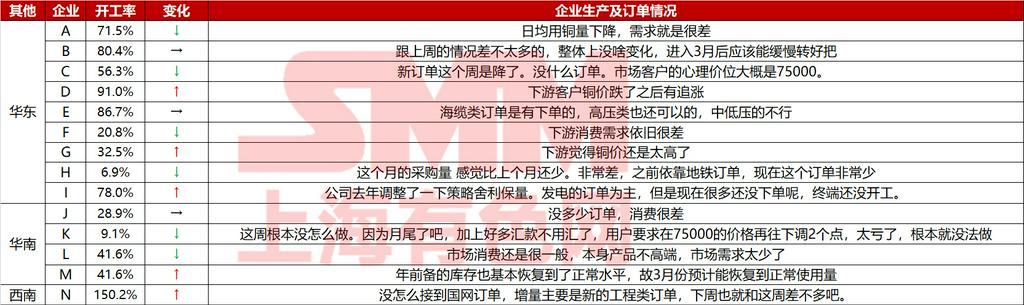

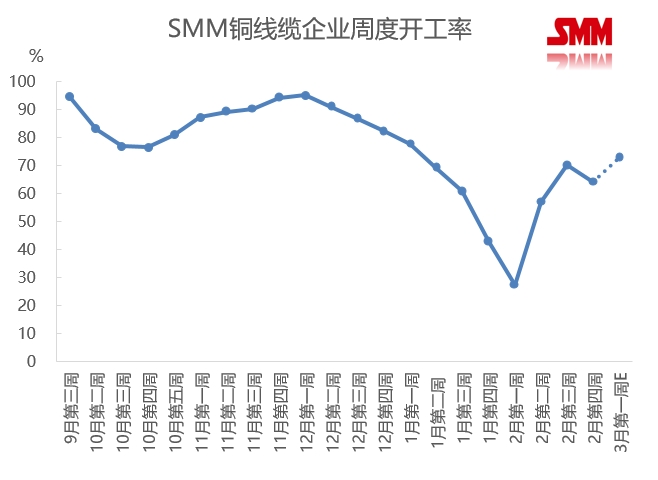

This week (2.21-2.27), the operating rate of SMM wire and cable enterprises was 64.32%, down 5.76 percentage points MoM, significantly below the expected operating rate by 14.06 percentage points and 9.24 percentage points lower YoY compared to the same period of the Lunar New Year last year. This week, the operating rate in the copper wire and cable market showed a sharper-than-expected decline, with new orders falling short of expectations. Many enterprises reported a MoM decrease in new order increments this week. Therefore, during the post-holiday demand recovery phase, the operating rate of copper wire and cable enterprises declined instead of rising. According to SMM, the current high copper prices are the main factor suppressing customer orders, with most downstream psychological price levels around 75,000 yuan/mt. By industry, there was almost no new demand for medium- and low-voltage orders, while recent orders from the State Grid and China Southern Power Grid were also insufficient. Only high-end orders for high voltage and above performed moderately, while PV and submarine cable orders remained stable. Export orders performed excellently, mainly targeting Southeast Asia and the Middle East.

This week, raw material inventories of copper wire and cable enterprises recorded 18,210 mt, down 1.09% MoM; finished product inventories recorded 17,430 mt, up 0.03% MoM. With copper prices remaining high and new order growth underperforming, enterprises are strictly controlling inventory levels to balance financial pressure.

This week, the underperformance of new order growth undoubtedly dealt a blow to the confidence of copper wire and cable enterprises. The market remains pessimistic about the speed and volume of order recovery, with most enterprises believing that the current recovery pace is significantly slower YoY compared to last year. Meanwhile, under the backdrop of high macroeconomic uncertainty and unclear copper price trends, end-user order volumes are very limited. Additionally, current copper prices are at a high level, far exceeding downstream customers' psychological price levels. Therefore, SMM expects that next week (2.28-3.6), orders for copper wire and cable enterprises will increase by 8.75 percentage points MoM to 73.08%.